About FT Professional

FT Professional provides businesses and governments with trusted journalism and tools for informed decisions.

Ask FT

Ask FT gives you quick AI-generated summaries of relevant coverage from the FT – just ask a question.

Free trial

Start your free trial today and gain immediate access to all FT Professional content – all tailored for you.

Unlock exclusive event passes to wider your network with FT Professional

Virtual access to FT events, including conferences, summits, forums, and panel discussions on global business, economics, technology, and finance,

Our network is your network.

This conference from the Financial Times, held in partnership with Sino Group, will bring together local and international business leaders, innovators and experts to explore Hong Kong’s evolving value proposition, and discuss how the city can solidify its stature as Asia-Pacific’s gateway to the world.

Key Discussion Points

- Asia-Pacific and beyond — How will changing trade and investment trade patterns impact economies across Asia-Pacific as well as Hong Kong’s strategic positioning?

- Global magnetism — What are the core factors currently shaping perceptions of Hong Kong as a place to live and do business?

- Innovation potential — How can Hong Kong enhance its competitive edge in deep tech, life sciences and AI?

The speaker line-up includes:

Robin Harding

Asia Editor

Financial Times

Arjun Neil Alim

Asia Financial Correspondent

Financial Times

Paul Chan

Financial Secretary

Hong Kong Special

Administrative Region

Government

Rachel Huf

Hong Kong CEO and

General Counsel for Asia-Pacific

Barclays

Aveline San

CEO and Banking Head

Citi Hong Kong

Clara Chan

Chief Executive Officer

Hong Kong Investment

Corporation Limited

Jeremy Sheldon

Chair

The British Chamber of Commerce

in Hong Kong

This webinar, hosted by the Financial Times, will examine the positioning of Hong Kong's capital markets.

Our expert panel will also discuss its relationship with mainland China, challenges in attracting listings, and strategies to reclaim its strength as a global capital markets hub.

This webinar, hosted by the Financial Times, will examine the far-reaching implications for Asia of the US presidential election.

A panel of experts will discuss the possible economic and political consequences, with an emphasis on how the contest will shape financial markets and global trade.

This exclusive webinar is brought to you by the FT Professional. FT Live, and FT Board Director Programme, where we hosted a panel of subject matter experts from UBS, Mizuho Securities, and Edelman, moderated by Leo Lewis, FT Asia Business Editor.

It is expected that Asia will deliver two-thirds of global growth in 2024. How do factors like low inflation, interest rates, rising prices and geopolitics shape consumer trends in the region? What is driving consumption and where are the opportunities?

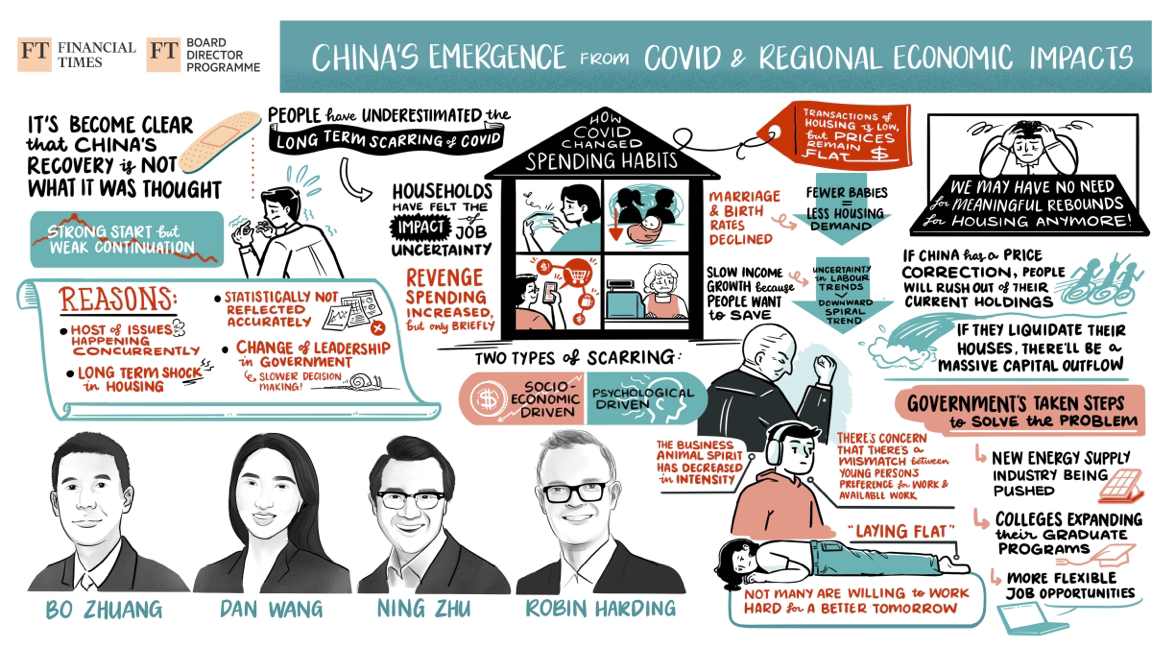

This exclusive webinar is brought to you by the FT Board Director Programme and FT Corporate Subscription team where we hosted a panel of subject matter experts from Loomis, Sayles & Company, Hang Seng Bank China, Brunswick Group, moderated by Robin Harding, FT Asia Editor.

Six months into China's reopening after Covid-19, what is the state of its economic recovery? This panel discussion was mainly focused on China's emergence from COVID and the regional economic impacts.

This virtual complimentary is brought to you by FT Professional and FT Board Director Programme, where we hosted a panel of subject matter experts from Ashurst, TTI and Macquarie, moderated by Simon Mundy, FT Moral Money Editor.

This panel discussion will focus on some of the most topical and challenging questions in the environmental, social and governance space.

How can businesses avoid accusations of greenwashing by ensuring that their bold words come alongside real results?

Where should businesses focus their effort and resources to become ESG leaders?

And what are the key developments to watch out for in policy and regulation?

This virtual complimentary is brought to you by FT Professional and FT Board Director Programme, where we hosted a panel of subject matter experts from Ashurst, TS Lombard and S&P Global Market Intelligence, moderated by Robin Harding, FT Asia Editor.

The main focus of the discussion was around the economic fallout in Asia impacted by the global economic dislocation from sanctions, supply chain disruption and rising commodity prices, where are addressed in the virtual session.

In-Person & Digital | Singapore

In its third year, Wealth Management Summit Asia is FT Live and PWM’s gathering of market-leading private banks, family offices and wealth managers, discussing how best to reap the rewards of Asia’s structural growth.

From interactive panel discussions to exclusive roundtables and masterclasses, this year’s conference uncovered outperforming business models and how investors can angle for higher returns in the face of looming geopolitical risks.

In-Person & Digital | Singapore

Transforming mainstream finance.

The inaugural Crypto & Digital Assets Summit Asia, co-organised by the Financial Times and The Banker, will convene leaders from global and Asian financial institutions, crypto and digital assets leaders and regulators to ascertain the path to institutional adoption, asset tokenisation and regulatory implementation.

In-Person Briefing | Singapore

Business transformation is at the forefront of corporate strategy, reflecting a significant shift towards dynamic, data-driven operations. This transformation, driven by rapid technological advancements, evolving regulatory landscapes and the growing demand for real-time insights, is reshaping how companies operate and compete. As digital transformation accelerates, new opportunities arise to optimise processes, enhance customer experiences, and streamline operations.

This high-level briefing, hosted by the Financial Times in partnership with Amazon Web Services and HCLTech, will convene senior executives from diverse industries to delve into the strategic and tactical considerations of business transformation and the role AI can play.

Online

The APAC M&A landscape is undergoing a significant transformation. China, formerly the dominant force in dealmaking, is encountering a deceleration due to economic challenges and stringent regulatory measures. This transition is paving the way for India and Japan to emerge as the new focal points of M&A activity in the region.

This webinar, organised by the Financial Times in partnership with Datasite, convened dealmakers to explore M&A activity and trends in the APAC region. The focus of the webinar was on the opportunities and challenges that would be faced by dealmakers in 2025.

Online

This an exclusive webinar with Financial Times and Nikkei Asia journalists to examine what lies ahead for India after the first 100 days of Prime Minister Narendra Modi's third term in office.

Our panel will take your questions on what has or will change after the Bharatiya Janata party (BJP) was forced into a coalition after failing to secure a majority in the 2024 general election.

In-person Briefing | Singapore

With Asia-Pacific accounting for more than half the world’s population and leading the global rise in energy demand, a successful energy transition in the region is essential to any international efforts to tackle climate change and reduce emissions.

This briefing from the Financial Times – in partnership with ABB – will bring together industry leaders, policymakers and experts to assess the current status of the energy transition in Asia and what the next phases will look like.

In-Person & Online | Singapore

At a time of heightened uncertainty, companies’ globalisation strategies are evolving as they seek to mitigate risk through diversification of markets, supply chains, products and financing sources. Meanwhile, rapid digital transformation and the drive for innovation demands a new approach to corporate growth.

Join the Financial Times for a high-level briefing, in partnership with DBS, as corporate finance and treasury leaders and other experts discuss how these functions are adapting to changes in the global business environment and what role they will play in Asia-Pacific’s future as an investment destination.

Achieve more with FT Professional subscription

Find our how you can leverage an FT Professional subscription to identify risks and opportunities.